The Star reported today (September 14, 2009) that the US, in response to a petition filed by the United Steelworkers Union, imposed a 35% duty on Chinese-made tyres.

If this isn't protectionist, what is. Is this the example that the leader of the "free world" sets when a specific sector loses some jobs? Who runs America - the people (consumers, public) or a special interest group (a union).

In a free market no such grouping should have the power to influence the government to dish out favours to a small group againnst the interest of the larger population.

But I guess we should be looking elswhere for examples of liberal free market trade policies.

Monday, September 14, 2009

Wednesday, June 17, 2009

This is how they did it in 1943

http://www.youtube.com/watch?v=gJ69X1qt4sQ

I believe that these should have been loans to be repaid by the companies that benefited from the war contracts - some kind of a loan repayment scheme.

Here is another...

This is how the video poster explains it:

A year after the United States entered the Second World War the federal government needed additional revenues to pay for the war effort. Congress had given away much of the government's usual means of financing itself, printing its own money, when it created the Federal Reserve in 1913. A voluntary income tax had been in place for 29 years, but for Constitutional reasons, fewer than 11 percent of Americans had to pay the income tax at that time. As a result, Congress enacted into law the Victory Tax Act of 1942, which included concurrent law for automatic wage withholding. The Victory Tax was a direct tax on income. However Article 1, Section 2, Clause 3 of the U.S. Constitution requires that direct taxes be apportioned to the several states, not citizens directly, and therefore it was unconstitutional. The government attempted to legitimize these new laws by citing Article 1, Section 5, Clause 2 of the Constitution: "To support Armies but no apportionment for money to that use shall be a longer term than 2 years."

The new legislation gave Henry Morgenthau, then Secretary of the Treasury, two voluntary income taxes to which he needed the voluntary compliance of US citizens. In December 1942, Morgenthau came up with a brilliant idea to encourage Americans to volunteer to pay by making the income tax a patriotic duty. To help implement this idea, Morgenthau ordered John J. Sullivan, a Treasury Department official, to contact Walt Disney.

Remember there was no television in the early 40s. The only visual medium the government could use to reach the public were films at movie houses. Going to the movies was a popular pastime, and citizens usually attended nearly every week. Walt was asked to fly to D.C. to discuss an urgent special request. At first, Walt was reluctant, but Sullivan insisted. Sullivan did not disclose the purpose of this meeting, and Walt assumed it had to do with the promotion of War Bonds. The next day, when Mr. Disney arrived to meet with Morgenthau and Internal Revenue Commissioner Guy Helvering, it was announced that the U.S. wanted him to "help us sell people on paying the income tax." Confused, Walt questioned why the government just didn't jail people who did not pay the income tax. Mr. Helvering retorted, "Walt, we want people to be enthusiastic about paying their taxes." Walt did not know that an unconstitutional income tax could not be used to jail American citizens for non-payment. That was then.

The Spirit Of '43 makes no mention of the impending "withholding" from workers' paychecks, yet it is quite obviously intended to promote the desirability of withholding, if be it responsibly by oneself until quarterly payment came due. Beardsley Ruml, Chairman of the Federal Reserve Board of New York would later introduce pay-as-you-go tax withholding in the work place so citizens would never again be "caught short" on tax day.

The Same Voluntary Tax Remains Today.

The Victory Tax Act was renewed in 1944 and was to expire when the war was over, yet remains in effect today, codified under the Internal Revenue Code at code section 3402 in subtitle C - Wage and Employment Tax, not the "Income" Tax. When WWII was over, Washington simply could not let go of its newfound riches - the payroll tax the public had been conditioned to accept. The constitutionality of the Victory Tax Act was never challenged by the people of the United States. The psychology and influence [propaganda] developed in The Spirit of '43 through its use of surreal imagery and feelings of National Patriotism and civic duty to - as the narrator puts it... " pay your taxes gladly and proudly" to fight an evil and powerful enemy, "The Axis" of Germany and Japan, accomplished its goal to get Americans to pay this voluntary tax. Any citizen questioning the tax might as well be considered the enemy by the end of this film clip. This should provide you some insights into how we have progressed to this modern state of voluntary complacency about our tax burden when our government tells us it is for our own good. And most of us are not even legally required to pay taxes. We have been convinced to pay taxes by practices that evolved out of cartoon propaganda and a sense of war-time patriotism. Careful examination of the law will show that the meaning of income is not legally defined to mean your income. Most people only become a taxpayer by volunteering to file a tax report or withholding form. And the IRS won't tell you otherwise. No part of the Federal Government is constitutionally permitted to levy such a direct tax on citizens of States and no amendment to the Constitution has changed that, not even the 16th amendment.

I believe that these should have been loans to be repaid by the companies that benefited from the war contracts - some kind of a loan repayment scheme.

Here is another...

This is how the video poster explains it:

A year after the United States entered the Second World War the federal government needed additional revenues to pay for the war effort. Congress had given away much of the government's usual means of financing itself, printing its own money, when it created the Federal Reserve in 1913. A voluntary income tax had been in place for 29 years, but for Constitutional reasons, fewer than 11 percent of Americans had to pay the income tax at that time. As a result, Congress enacted into law the Victory Tax Act of 1942, which included concurrent law for automatic wage withholding. The Victory Tax was a direct tax on income. However Article 1, Section 2, Clause 3 of the U.S. Constitution requires that direct taxes be apportioned to the several states, not citizens directly, and therefore it was unconstitutional. The government attempted to legitimize these new laws by citing Article 1, Section 5, Clause 2 of the Constitution: "To support Armies but no apportionment for money to that use shall be a longer term than 2 years."

The new legislation gave Henry Morgenthau, then Secretary of the Treasury, two voluntary income taxes to which he needed the voluntary compliance of US citizens. In December 1942, Morgenthau came up with a brilliant idea to encourage Americans to volunteer to pay by making the income tax a patriotic duty. To help implement this idea, Morgenthau ordered John J. Sullivan, a Treasury Department official, to contact Walt Disney.

Remember there was no television in the early 40s. The only visual medium the government could use to reach the public were films at movie houses. Going to the movies was a popular pastime, and citizens usually attended nearly every week. Walt was asked to fly to D.C. to discuss an urgent special request. At first, Walt was reluctant, but Sullivan insisted. Sullivan did not disclose the purpose of this meeting, and Walt assumed it had to do with the promotion of War Bonds. The next day, when Mr. Disney arrived to meet with Morgenthau and Internal Revenue Commissioner Guy Helvering, it was announced that the U.S. wanted him to "help us sell people on paying the income tax." Confused, Walt questioned why the government just didn't jail people who did not pay the income tax. Mr. Helvering retorted, "Walt, we want people to be enthusiastic about paying their taxes." Walt did not know that an unconstitutional income tax could not be used to jail American citizens for non-payment. That was then.

The Spirit Of '43 makes no mention of the impending "withholding" from workers' paychecks, yet it is quite obviously intended to promote the desirability of withholding, if be it responsibly by oneself until quarterly payment came due. Beardsley Ruml, Chairman of the Federal Reserve Board of New York would later introduce pay-as-you-go tax withholding in the work place so citizens would never again be "caught short" on tax day.

The Same Voluntary Tax Remains Today.

The Victory Tax Act was renewed in 1944 and was to expire when the war was over, yet remains in effect today, codified under the Internal Revenue Code at code section 3402 in subtitle C - Wage and Employment Tax, not the "Income" Tax. When WWII was over, Washington simply could not let go of its newfound riches - the payroll tax the public had been conditioned to accept. The constitutionality of the Victory Tax Act was never challenged by the people of the United States. The psychology and influence [propaganda] developed in The Spirit of '43 through its use of surreal imagery and feelings of National Patriotism and civic duty to - as the narrator puts it... " pay your taxes gladly and proudly" to fight an evil and powerful enemy, "The Axis" of Germany and Japan, accomplished its goal to get Americans to pay this voluntary tax. Any citizen questioning the tax might as well be considered the enemy by the end of this film clip. This should provide you some insights into how we have progressed to this modern state of voluntary complacency about our tax burden when our government tells us it is for our own good. And most of us are not even legally required to pay taxes. We have been convinced to pay taxes by practices that evolved out of cartoon propaganda and a sense of war-time patriotism. Careful examination of the law will show that the meaning of income is not legally defined to mean your income. Most people only become a taxpayer by volunteering to file a tax report or withholding form. And the IRS won't tell you otherwise. No part of the Federal Government is constitutionally permitted to levy such a direct tax on citizens of States and no amendment to the Constitution has changed that, not even the 16th amendment.

Thursday, June 4, 2009

Tuesday, June 2, 2009

Mp3Raid music code

Let me tell you how it will be

There's one for you, nineteen for me

'Cause I'm the taxman, yeah, I'm the taxman

Should five per cent appear too small

Be thankful I don't take it all

'Cause I'm the taxman, yeah I'm the taxman

If you drive a car, I'll tax the street,

If you try to sit, I'll tax your seat.

If you get too cold I'll tax the heat,

If you take a walk, I'll tax your feet.

Don't ask me what I want it for

If you don't want to pay some more

'Cause I'm the taxman, yeah, I'm the taxman

Now my advice for those who die

Declare the pennies on your eyes

'Cause I'm the taxman, yeah, I'm the taxman

And you're working for no one but me.

Saturday, May 23, 2009

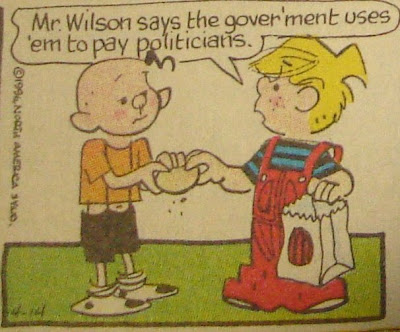

Dennis the menace

Leon Louw from the Libsa googlegroup:

The core functions of government are -

1.. Confiscate wealth ("tax") from net producers of wealth and transfer it to ("subsidise") net consumers of wealth, especially politicians and officials.

2.. Smother ("regulate") wealth-producers and unleash ("liberate") wealth-consumers, especially tax-consuming academics with "academic freedom" and politicians with "parliamentary privilege" (and much more).

3.. Punish managers and owners who run businesses successfully by transferring wealth they generate to failed managers and owners ("bailouts").

4.. Reduce the value of everyone's money by increasing the money supply ("stimulus").

5.. Drain essential capital from the economy ("borrowing requirement").

Almost everything governments do would not just be a heinous crime if done by a private person (restricting liberty; redistributing wealth etc), but conclusive evidence of certifiable insanity. What would happen to a private person who walked up to two people interacting freely, say agreeing to a contract, smoke in their office or drive without seatbelts, pulls a gun and says "If you don't do as I say I'll steal your money ("fine you"), confiscate your house and car ("asset forfeiture"), and evict you from your property ("business regulation")? Well, they would escape trial because they'd be certified and sent to an asylum.

http://groups.google.co.za/group/libsa/browse_thread/thread/49fc5db214b43eab/45cbece954d5c308?hl=en&q=libertarian+%22South+Africa%22+watkins

Subscribe to:

Posts (Atom)